Little Known Facts About Financial Advisors.

A Monetary Advisor is a specialist who supplies skilled assistance on managing funds and producing educated fiscal decisions. These advisors present A variety of solutions, together with financial commitment management, retirement setting up, estate organizing, tax procedures, and threat administration. Their objective is that can help customers realize their financial aims and establish a secure fiscal future.

Essential Tasks of Financial Advisors

Expenditure Administration

Financial Advisors aid purchasers develop and control financial investment portfolios tailored to their threat tolerance, money plans, and time horizon. They provide suggestions on asset allocation, diversification, and financial commitment procedures. By continuously monitoring industry problems and altering portfolios as wanted, they purpose to improve returns though managing risk.

Retirement Preparing

Organizing for retirement is actually a essential provider supplied by Monetary Advisors. They help customers in identifying simply how much to save for retirement, choosing suitable retirement accounts, and choosing investments that will mature eventually. In addition they support consumers develop withdrawal methods to make certain that their retirement financial savings last all over their retirement yrs.

Estate Arranging

Monetary Advisors work with shoppers to produce complete estate plans that define how assets are going to be dispersed upon Demise. This contains creating wills, trusts, together with other legal files. Additionally they provide tips on minimizing estate taxes and guaranteeing that beneficiaries are designated effectively.

Tax Methods

Reducing tax liability is a vital aspect of economic planning. Money Advisors assist purchasers comprehend the tax implications in their financial choices and establish methods to lessen taxes. This might require tax-successful investing, retirement account contributions, and charitable supplying techniques.

Possibility Administration

Guarding property is very important, and Monetary Advisors support shoppers evaluate their insurance policy demands and choose appropriate coverage. This contains lifetime insurance, well being insurance policies, incapacity insurance, and lengthy-phrase care insurance policies. Advisors be sure that shoppers are sufficiently shielded versus unexpected situations which could impact their financial well-being.

Significance of Financial Advisors

Individualized Economical Designs

Economical Advisors build personalised fiscal strategies determined by personal consumer needs, goals, and instances. These customized programs supply a roadmap for achieving economical aims, supplying customers a transparent path to adhere to.

Expertise and Know-how

With their comprehensive understanding of monetary marketplaces, expense products, tax Wealth Management legislation, and estate organizing strategies, Money Advisors provide important insights that men and women may not have by themselves. Their expertise can help customers make educated decisions and prevent frequent economical pitfalls.

Comfort

Running finances is often complex and tense. Financial Advisors give relief by taking on the accountability of monetary preparing and administration. Shoppers can really feel self-confident that their funds are being dealt with by pros, allowing them to give attention to other areas of their life.

Long-Phrase Romantic relationship

Economical Advisors often Develop prolonged-expression interactions with their shoppers, continuously working with them as their monetary conditions and ambitions evolve. This ongoing partnership makes certain that money designs remain relevant and efficient with time.

Selecting a Economic Advisor

When picking a Economic Advisor, it's important to think about their qualifications, encounter, and fee structure. Look for advisors who will be Accredited, have a superb status, and offer you transparent fee preparations. It is additionally useful to select an advisor who focuses on areas applicable on your fiscal wants.

In summary, Money Advisors Engage in a vital purpose in supporting people and people obtain their monetary goals. By giving specialist advice and personalized financial plans, they guide clients from the complexities of handling their funds, ensuring a safer and prosperous financial long run.

Danny Tamberelli Then & Now!

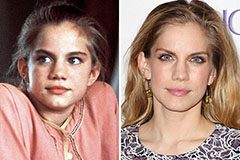

Danny Tamberelli Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now!